Delve into the world of real estate management, a field that plays a crucial role in maximizing property investments. From overseeing property maintenance to navigating financial strategies, real estate managers hold the key to unlocking the full potential of real estate assets.

As we journey through the intricacies of real estate management, we will explore the diverse responsibilities, challenges, and strategies that shape the industry.

Introduction to Real Estate Management

Real estate management involves the operation, control, and oversight of real estate properties. It plays a crucial role in maximizing the value of properties and ensuring a positive return on investment for property owners. Effective real estate management is essential for maintaining and increasing property value over time.

Key Responsibilities of Real Estate Managers

- Property Maintenance: Ensuring that properties are well-maintained and in good condition to attract tenants or buyers.

- Tenant Relations: Managing tenant relationships, addressing concerns, and ensuring tenant satisfaction.

- Financial Management: Handling rent collection, budgeting, and financial reporting for property owners.

- Marketing and Leasing: Advertising properties, screening potential tenants, and negotiating leases.

- Legal Compliance: Ensuring properties comply with local laws, regulations, and zoning requirements.

Importance of Effective Real Estate Management for Property Value

Real estate management directly impacts property value by maintaining the physical condition of properties, attracting and retaining quality tenants, optimizing rental income, and minimizing vacancies. A well-managed property is more likely to appreciate in value over time and generate higher returns for property owners.

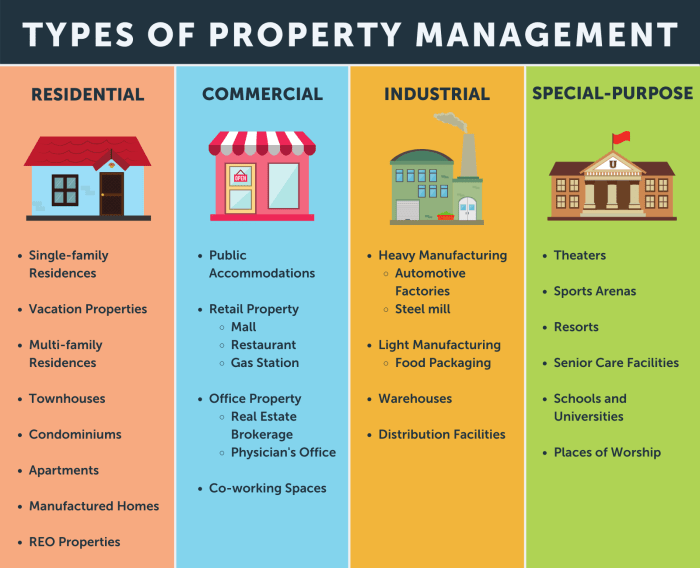

Types of Real Estate Management

Residential, commercial, and industrial properties are some of the main types of real estate that require management. Each type presents unique challenges and requires specific strategies to ensure successful management.

Residential Real Estate Management

Residential properties include single-family homes, apartments, condominiums, and townhouses. Management strategies for residential properties often focus on tenant relations, maintenance, and ensuring the property is well-maintained. Challenges can include dealing with tenant turnover, collecting rent, and addressing maintenance issues in a timely manner.

Commercial Real Estate Management

Commercial properties encompass office buildings, retail spaces, and warehouses. Managing commercial real estate involves leasing to businesses, maintaining common areas, and ensuring compliance with zoning regulations. Challenges in commercial real estate management can include negotiating leases, attracting and retaining tenants, and managing property expenses.

Industrial Real Estate Management

Industrial properties include manufacturing facilities, distribution centers, and warehouses. Effective management of industrial real estate requires expertise in logistics, maintenance of specialized equipment, and compliance with industry regulations. Challenges in industrial real estate management may involve managing complex supply chains, ensuring safety standards are met, and adapting to changing market demands.

Property Maintenance and Upkeep

Regular property maintenance is crucial in real estate management to ensure the longevity and value of the property. By keeping up with maintenance tasks, real estate managers can enhance the overall appeal of the property, attract quality tenants, and prevent costly repairs in the future.

Common Maintenance Tasks

- Regular inspections of the property for any signs of wear and tear

- Landscaping and gardening to maintain curb appeal

- HVAC system maintenance to ensure proper functioning

- Painting and touch-ups to keep the property looking fresh

- Plumbing and electrical system checks to address any issues promptly

Cost-effective Upkeep Strategies

- Implement a preventative maintenance schedule to catch issues early on

- Regularly clean and maintain common areas to prevent deterioration

- Invest in energy-efficient upgrades to reduce long-term utility costs

- Negotiate bulk discounts with maintenance service providers for cost savings

- Train on-site staff to handle minor maintenance tasks to reduce outsourcing expenses

Tenant Management

Real estate managers play a crucial role in tenant selection and leasing, ensuring that the right tenants are placed in the properties they manage. They are responsible for screening potential tenants, verifying their background, credit history, and rental references to ensure they are reliable and capable of fulfilling their lease obligations.

Maintaining Positive Tenant Relationships

Building and maintaining positive relationships with tenants is essential for tenant retention and overall satisfaction. Real estate managers can implement the following strategies:

- Communication: Regular and clear communication with tenants can help address any concerns or issues promptly.

- Respect and Professionalism: Treating tenants with respect and professionalism fosters a positive landlord-tenant relationship.

- Quick Response: Responding quickly to maintenance requests and inquiries shows tenants that their needs are valued.

- Fairness: Enforcing lease agreements fairly and consistently helps build trust with tenants.

Handling Tenant Issues and Disputes Effectively

Tenant issues and disputes can arise, and it is essential for real estate managers to address them promptly and effectively to maintain a harmonious living environment. Strategies for handling tenant issues include:

- Mediation: Acting as a mediator to resolve conflicts between tenants or between tenants and the landlord.

- Enforcement of Lease Terms: Enforcing lease terms and policies when necessary to ensure compliance and prevent future issues.

- Documentation: Keeping detailed records of communication and incidents can help resolve disputes and protect all parties involved.

- Legal Assistance: Seeking legal advice or assistance for complex tenant issues or disputes can help navigate legal regulations and procedures.

Financial Management in Real Estate

Real estate management involves various financial aspects that are crucial for the successful operation of properties. From budgeting to rent collection, financial management plays a key role in ensuring the profitability and sustainability of real estate assets.

Budgeting and Financial Planning

Effective budgeting is essential for real estate management as it helps in estimating income, expenses, and overall financial performance. Property managers need to create detailed budgets that account for operating costs, maintenance expenses, taxes, insurance, and other financial obligations. By forecasting revenue and expenses accurately, property owners can make informed decisions to maximize profitability and achieve long-term financial goals.

Rent Collection and Revenue Maximization

Rent collection is a critical aspect of financial management in real estate. Property managers must ensure timely collection of rent from tenants to maintain cash flow and meet financial obligations. Strategies such as offering incentives for early payments, implementing efficient rent collection systems, and addressing tenant concerns promptly can help maximize revenue and minimize delinquencies.

Additionally, property managers can explore opportunities to increase rental income through rent adjustments, lease renewals, and value-added services to enhance the overall financial performance of the property.

Expense Reduction and Cost Control

Reducing expenses is essential for improving the profitability of real estate operations. Property managers can implement cost-saving measures such as energy-efficient upgrades, preventive maintenance programs, vendor negotiations, and smart procurement strategies to lower operating costs without compromising the quality of property services.

By monitoring expenses closely and identifying areas for optimization, property owners can enhance the financial performance of their assets and ensure long-term sustainability.

Importance of Financial Planning in Long-Term Property Management

Financial planning is integral to the long-term success of real estate investments. By developing comprehensive financial strategies, property owners can align their short-term objectives with their long-term financial goals. Effective financial planning involves evaluating investment opportunities, assessing risk factors, diversifying portfolios, and implementing sound financial practices to maximize returns and mitigate potential financial challenges.

Through proactive financial planning, property owners can secure the financial stability and growth of their real estate assets for years to come.

Legal Compliance and Risk Management

Real estate managers are required to adhere to various legal requirements to ensure the smooth operation of properties and compliance with local regulations. In addition, risk management plays a crucial role in identifying and mitigating potential risks that could affect the properties under management.

Legal Requirements for Real Estate Managers

- Ensuring properties meet building codes and safety regulations

- Complying with landlord-tenant laws and regulations

- Handling lease agreements and rental payments in accordance with legal requirements

- Adhering to fair housing laws to prevent discrimination

Risk Management in Real Estate Operations

Risk management in real estate involves identifying, assessing, and prioritizing risks that could impact the properties managed. It includes developing strategies to mitigate or eliminate these risks to protect the value of the properties and ensure the safety of tenants and occupants.

Potential Legal Issues in Real Estate Management

- Disputes over lease agreements and rental payments

- Violations of building codes or safety regulations

- Non-compliance with fair housing laws leading to discrimination claims

- Property damage or injuries on the premises leading to liability issues

By staying informed about legal requirements, implementing robust risk management strategies, and addressing potential legal issues proactively, real estate managers can effectively navigate the complexities of legal compliance and risk management in the industry.

Technology in Real Estate Management

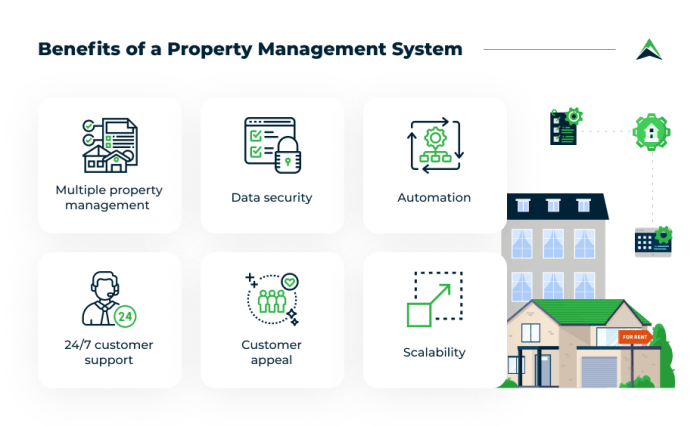

Technology plays a crucial role in modern real estate management, revolutionizing the way properties are managed and maintained. With the advent of property management software and automation tools, the industry has witnessed significant transformations in efficiency and productivity.

Property Management Software

Property management software has become a cornerstone in real estate management, allowing for streamlined operations, centralized data management, and improved communication with tenants and vendors. These tools enable real estate professionals to track leases, manage maintenance requests, and generate financial reports with ease.

Automation in Maintenance and Operations

Automation technologies have optimized property maintenance and operations by scheduling routine tasks, monitoring equipment performance, and detecting potential issues before they escalate. For example, smart building systems can adjust temperature settings, lighting, and security protocols automatically, enhancing energy efficiency and tenant comfort.

Virtual Reality and Augmented Reality

Virtual reality (VR) and augmented reality (AR) are increasingly used in real estate management for virtual property tours, design visualization, and space planning. These immersive technologies allow prospective tenants or buyers to experience properties remotely, saving time and resources for both parties.

Blockchain in Real Estate Transactions

Blockchain technology is gaining traction in real estate transactions for secure, transparent, and efficient property sales and leasing processes. By creating immutable digital records of ownership, contracts, and payments, blockchain minimizes fraud risks and expedites the closing process, benefitting all stakeholders involved.

Summary

In conclusion, real estate management stands as a cornerstone in the realm of property investments. By embracing effective management practices, property owners can enhance their assets, foster positive tenant relationships, and secure long-term financial growth.

FAQ Summary

What are the key responsibilities of real estate managers?

Real estate managers are tasked with overseeing property maintenance, tenant selection and leasing, financial management, legal compliance, and risk management.

How can property owners maximize revenue in real estate operations?

Property owners can maximize revenue by implementing effective rent collection strategies, reducing unnecessary expenses, and optimizing property maintenance to attract higher-paying tenants.

What role does technology play in modern real estate management?

Technology has revolutionized real estate management practices by offering tools like property management software and automation, streamlining processes, enhancing efficiency, and improving overall productivity.